Rethinking technology due diligence

The way private equity firms and Operating Partners interact with companies before a deal is a test of how they will engage later. Assessing technology should not be a tough process. Instead, it must be treated as an opportunity to understand the existing technology capabilities, how they align with growth goals, and how the current scenario could help or hinder efforts. Accurate tech diligence will help you understand capability gaps and prioritize a roadmap to fill them.

Having a plan, rather than sending in a technical team to complete a diligence check-list, is extremely important. Before addressing your assessment, you must have clarity about what your goals will be post-acquisition. For instance, you must ask yourself if the current company’s conditions allow for the power to scale and meet market expectations, or what is needed to increase revenue. Determining a company’s potential growth and the time it will take to achieve the desired ROI is key in early stages.

Even though considering technology early in the process could lead to faster and more successful growth and scalability, there are always options to use technology to empower business at any stage.

Driving portco growth and efficiency via technology

Once the deal is closed and the holding period starts, it’s time to leverage all the information gathered during the due diligence process. This will allow PEs and Operating Partners to set a clear roadmap and start to create value from day one. Once again, alignment with the investment goals is vital. For example, the strategy for a long-term holding period won’t be the same as for an investment strategy aimed at generating quick revenue growth and exit after 3 years.

Just like due diligence, applying technology during the holding period isn’t something we can standardize. Every company has unique characteristics and needs, and Operating Partners are essential to interpreting them. They fill the gap between PEs and the portcos’ management teams, and help them implement technology strategies that make sense for meeting investment expectations.

Assessing a company’s digital capabilities and developing them to their full potential may require firms to build out their digital capabilities or align them with strategic partners. As PE partners, we bring hands-on experience and technical know-how for turning ideas into action and building an effective digital strategy that ignites value creation.

Multi-level tech enablement for success

After an acquisition, technology supports the pursuit of rapid returns and increases the value-added multiplier. In turn, this generates new revenue sources, integrates vertical and horizontal value chains, digitizes product and service offerings, and expands the business model and customer access by offering new digital solutions such as complete data-driven services and integrated platform solutions.

However, enabling value creation goes beyond building or improving customer-facing services/products. Technology enablement at the internal level can make a company more efficient by optimizing in-house processes, which then lead to better business performance.

Tech value creation can (and must) happen at several levels, such as top-line performance, operational performance, cash flow management, organization, and governance. For instance, technology allows companies to spend more time on growth and client service excellence, and less time on detailed transactions and manual data entry.

The last mile, preparing for EXIT

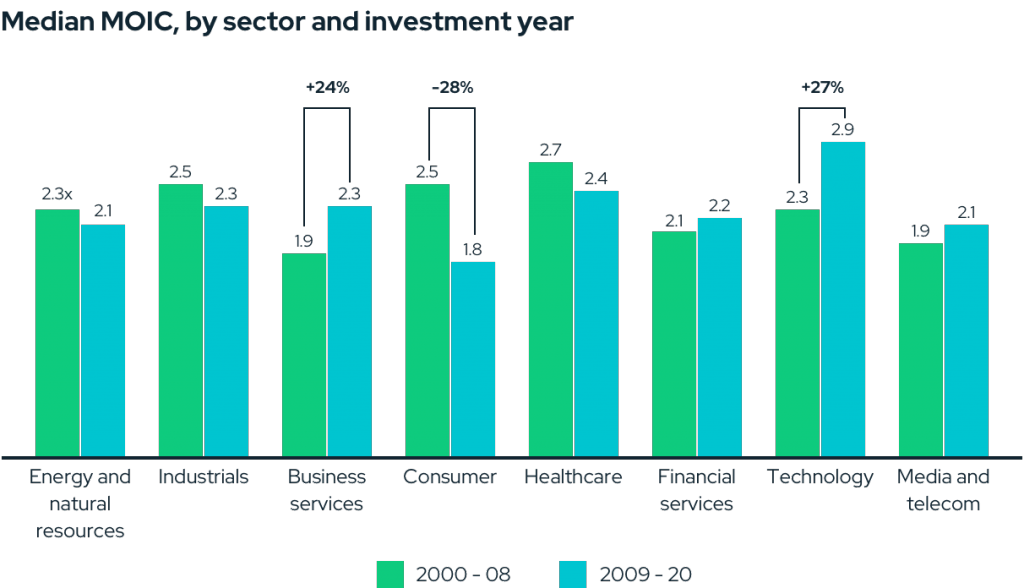

Developed early in the lifecycle of a deal, a value creation plan serves as a strategic blueprint to guide everything from diligence, to Day 1, to exit. Technology must be considered an essential part of any endeavor in order to unleash value for companies. In fact, according to Bain & Co’s report, technology deals (especially software investments) have produced stronger returns than other types.

For this reason, we must be ready to seize the opportunities of placing tech at the core of our plans. Our technical know-how helps us reshape businesses and create sustainable growth for long-term ownership or potential exits.

Last but not least, tech-enabled businesses are better prepared to face economic downturns, especially for enterprise software companies. While consumer-driven revenue can fall off when the economy slows, B2B customers are less unstable. That’s because most enterprise software performs necessary business functions and is embedded in workflows. These factors, among others, explain why returns from tech deals have outpaced those of non-tech deals.

Wrapping up: technology at the core

In my opinion, digital enablement is a strategic imperative in the private equity world. With it, companies can boost value creation, improve operations and enhance investment returns. Although many believe the digital path is a hard road and many PEs don’t have the in-house resources to execute a tech value creation strategy, technology advisors early in the process can make it easier.

Technology is here to stay. More and more companies from different business verticals are becoming tech-enabled. That’s why having a technology partner must be at the core of the private equity playbook and considered an enabler for boosting your value and returns.