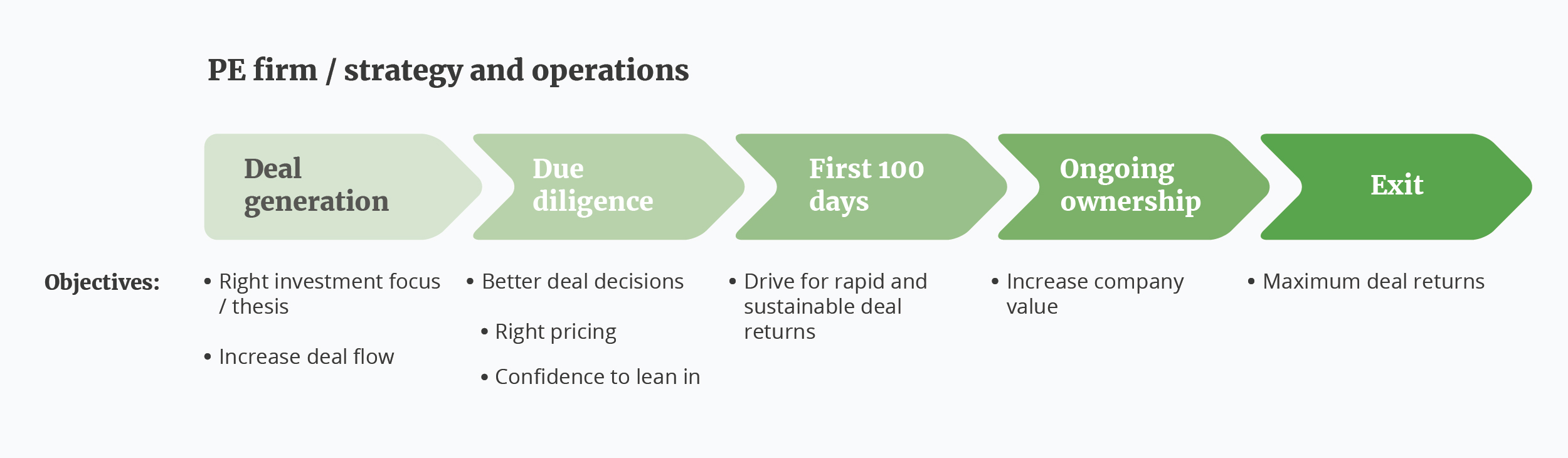

Private equity (PE) investments face different challenges, but they all have a common goal: to acquire a majority stake in an established company, generally in the mid-market segment, to give it a boost, free it from stagnation or make it grow through innovation and then sell it at a higher value. In this sense, artificial intelligence (AI) becomes an ally that goes through and leaves its mark on all the stages of a PE process.

The first step is known as deal generation. This is the instance in which the investment firm makes a decision on whether the company of interest is appropriate or not according to its previous experience, its current portfolio, or even its preferences. Already at this stage, it is possible to appeal to AI in discovery mode: what volume of data does the organization handle, what is happening in that sector in terms of value generation from the data, what restrictions exist. In industries such as health or public safety, for example, the amount of data available will be more than abundant, but privacy issues will mean that not all of it can be used freely, so the effort to be made will go beyond dumping everything into a data lake -which is, a common repository in which structured, semi-structured and unstructured data coexist- and start experimenting. As an example of that, a company in the agricultural sector that has its operations sensorized has enormous potential. Another analysis that the investor can do at this stage is to investigate the data culture of the organization to be acquired: Is there a mentality to extract value from data? Has it been done in the past?

Already at the due diligence stage, in which a preliminary investigation is carried out to get to know the company to be acquired in-depth, the PE can go deeper into the discovery process, now relying on concrete information. What is the state of the existing data? If shortcomings are found in terms of quality (existence of multiple databases, presence of legacy systems, inefficient or incomplete archiving schemes), the investor can rest assured: the traditional pipeline of data science work includes the tasks to resolve this situation. It does require effort, but by no means will it be an impediment, but it will by no means be an impediment. If the conflict is that the data that would be needed does not exist because it was never collected, the focus should be on how difficult it is to obtain it. Is it enough to incorporate sensors? Or does it imply a complete change in the way you work? The size of the barrier to overcome will depend on the answer to these questions.

Once the deal is closed, the third step in the PE process appears: the first 100 days. This is a key period in which changes are made that set the company’s course for the future: incorporate professionals to fill positions that did not exist, recruit new executives to make a change, and redefine strategies. At this point in the process, it is too soon to start an AI project because the company is going through an adaptation to the new leadership and taking the first steps in its cultural change. However, this technology can still be applied at this time to analyze, among different possible scenarios, which could be the most effective strategy to apply.

During the fourth step of the process, called ongoing ownership, the race starts to increase the value of the company. In this context, the AI card gains relevance, although most do not know how to play it. It is important, in this sense, to have a strategic approach: AI is a path, not a single shot, so trust must be maintained with the technology partner so that the process ends up yielding the expected results. A parallel could be drawn with teaching a person how to drive: after the first class, they will not be able to get out on the highway, but after a while, with enough experience, they will be able to solve any problem that arises at the wheel. Something similar happens with AI: it may not produce revenue at first, but it will certainly yield enormous value – learning, adapting to the new cultural mindset, unblocking barriers, internal transformations, greater knowledge of available technologies, interest in identifying the possible value of the data – which should be used as feedback and capitalized on for the following experiences.

The last stage of a PE’s investment process is the exit: the moment in which the re-valued company is sold in the market. In its report, The State of AI 2020, the consulting firm McKinsey found that the group of respondents who qualify as “leaders” in terms of adoption of this technology already attribute 20% or more of their organizations’ profits to Artificial Intelligence. The message is clear: those who have managed to establish an AI culture and have bet on this technology will see in the long term that the value of their investment, supported by the value of data, has multiplied.